What is Quicken Software? How to Manage Personal Finances with Quicken?

Managing personal finance is a skill every adult should master. No matter whether you are living by yourself or have a family, if you are not serious about your financial health, sooner or later you’ll face serious consequences. A lot of professionals, entrepreneurs, and individuals use Quicken to manage their personal finance. If you are unaware of it and keep wondering what is Quicken software, this blog will clear your doubts.

Note: You may like to read Create Quicken ID

Quicken: A Reliable Personal Finance Companion

Quicken is one of the most popular and oldest personal finance software that was first released in the year 1983. Since then, it has been used by millions, worldwide and helps an individual manage their personal finances digitally.

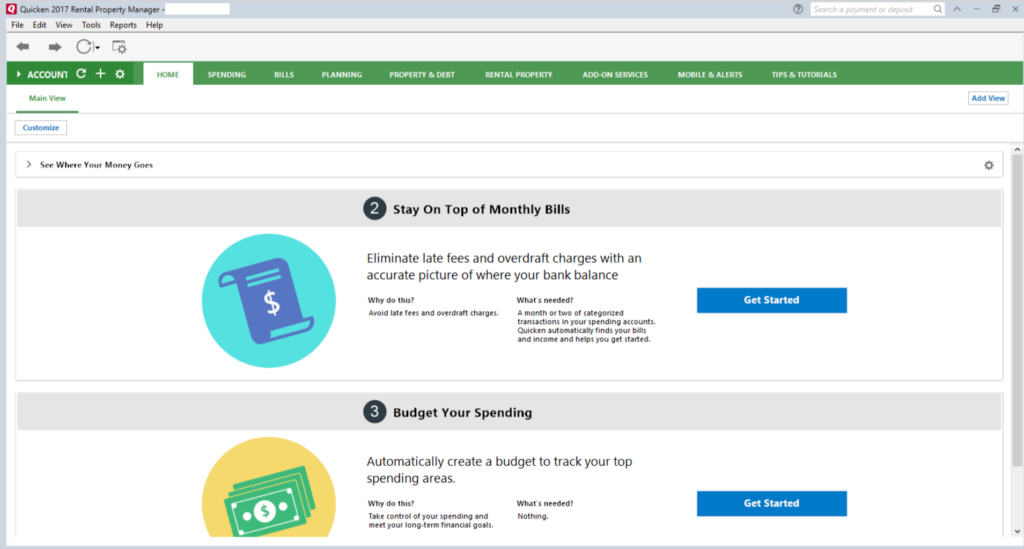

With the help of Quicken, a person can keep an eye on his/her expenses, create detailed domestic budgets and streamline personal finance goals. With an intuitive interface and useful financial features, Quicken is perfect for anyone who is looking to get started with personal finance. Here is everything you can do with Quicken:

1. Manage your income and expenses: You can connect all your bank accounts with Quicken software to keep an eye on spending and income, automatically.

2. Save wisely: When you see all your expenses on a single screen, you can easily discover saving opportunities by eliminating unnecessary expenses that you were not tracking earlier.

3. Automate budgeting: Use Quicken to get a dedicated monthly financial budget that the software prepares based on your routine expenses.

4. Update cash transactions manually: Never miss an expense by updating cash-only transactions manually in the system.

Managing Personal Finance with Quicken: Useful Tips to Help You Achieve Financial Goals

Maintaining your financial health by keeping an eye on personal finance is a tactic many millennials and baby boomers have ignored for long. Not only this bring stability to your finances but it gives you the ultimate peace of mind. You can achieve your personal and professional goals when you manage your personal finance.

Quicken allows you to get started quickly without overcomplicating things. Just keep the following things in mind and use Quicken for personal financial management to achieve your financial goals.

1. Creating a Monthly Budget

Before doing anything else, you need to have a proper monthly budget. This will help you maintain financial discipline and ensure all your financial goals are met. With the help of Quicken software, you can automate the process of budget creation and management.

Quicken tracks your spending and income patterns over several months once you connect it to your bank account and create a detailed budget. It also suggests you how to segregate your finances and reduce your expenses to get the most out of your income and minimize overspending.

2. Setting Up Savings Accounts

While it’s fine to stick to a checking account, you need to have a savings account if you want to enjoy excellent financial health. When you have a dedicated savings account, it provides a financial cushion in case of contingencies. This ensures that you do not fall into a debt trap by using credit limits to cover emergency expenses and stay afloat without wasting money.

It is always advisable to put money in your savings account regularly and at least have three months of routine expenses if you want to improve your financial health. When you have provisioned for emergencies, it becomes easier for you to focus on your other goals.

Quick Note: You may read add a bank account in Quicken

3. Retirement Savings

You might have often heard that it is never too early to start saving for your retirement. Well, this is really true. When you retire, all your income begins to vanish, and you still have years to live. In that case, your retirement fund is the only thing that will keep you afloat. The best way to start saving for your retirement is to start using a 401 (k) plan while you are working with your employer. Make sure to opt-in for a 401(k) account as your employer will be obligated to match the sum you choose to put in for your retirement.

Also, you should use Quicken to set automatic payment towards your IRA account. As a ballpark figure, you should contribute at least 20 percent of your income towards IRA. Quicken would help you manage all your retirement savings from a single dashboard.

4. Managing Your Debt

Once your expenses and savings are taken care of, it’s time to shift your focus towards paying off your existing loans and debts. Always pay for credit card bills on time as they attract high-interest rates. Quicken can help you prioritize your debt payments by giving you insightful repayment options that suit your goals and monthly budget.

When you get serious all the four things mentioned above, you will see an instant bump in your financial health and net worth which you can track using Quicken in real-time. Top of Form.

Quicken for Windows

Quicken for Windows is available with different editions Starter, Deluxe, Premier or Home & Business. Each edition has its own specific functionality.

1. Starter: It’s a basic edition for Quicken that can help you to download your banking transactions in one place, creating a budget and sync your data from the desktop to mobile.

2. Deluxe: It’s one of the popular editions among the user that fulfill all the starter requirements plus helps you to customize budget, create savings goals, etc.

3. Premier: This includes all the functionality of starter and deluxe editions. Plus you can pay your bills, simplify your taxes and investments.

4. Home & Business: It’s a bundle of fulfilling all the personal and small business financial activities such as to send a custom invoice with payment link, differentiate between the personal and business expenses.

PRICE QUOTES

| Quicken Products(Windows) | Starter | Deluxe | Premier | Home & Business |

| Price Range | $30-$35 | $45-$50 | $68-$75 | $90-$100 |

Quicken For Mac

With the extensive feature of Quicken for Windows, Quicken Inc. also developed Quicken for Mac for Apple product users. Before the release of Quicken 2019, there was only one edition for Mac but after it’s also available with different editions Starter, Deluxe, and Premier.

1. Starter: This version helps you to download the banking transactions, sync your data with the cloud, etc.

2. Deluxe: It includes all the starter features plus creates a customized budget, simplifies your taxes and investments and much more.

3. Premier: It includes all the functions of starter and deluxe edition plus helps you to pay bills and many more.

PRICE QUOTE

| Quicken Products | Starter | Deluxe | Premier |

| Price Range | $30-$35/yr | $45-$50/yr | $67-$75/yr |

Note: You can check the current price on Quicken official website

Key Points

- You can sync your Quicken data with mobile devices and keep an eye on your finance anytime anywhere.

- If you need accounting software for your business. You should read about QuickBooks Software.

- You can transfer data from another financial softwares too for example, Microsoft Money to Quicken, Moneyspire to Quicken etc.

Wrapping Up

Well, we believe now that you know what Quicken is and how to manage your personal finances efficiently. You can finally start realizing the full potential of financial management software like Quicken. Still, if you have any confusion or get stuck anywhere while using Quicken, you can always get in touch with professional support experts to help you out. We provide on-call and live chat support to help you solve your Quicken issues, quickly. Get in touch with our experts now. TollFree 1-877-353-8076

Important Links:

1. Reconcile Accounts in Quicken for Windows/Mac

2. Complete Guide for Quicken (Only for Windows)

3. Transfer Quicken from one computer to another